If you hire independent contractors or freelancers for any business-related purpose-such as taking product photos for your online store or writing posts for your company blog-this cost is a tax deduction.

Deduct gross salaries and other benefits, such as the Canada Pension Plan (CPP) and Employment Insurance (EI) premiums you pay to employees. For home offices, deductions must be in line with the actual size of the space you’re using for your business. Expenses for heat, electricity, insurance, maintenance, mortgage interest, and property taxes. Telephone, cell phone, cable and internet are all deductible if these expenses are related to business activities. That means you can deduct 20% of your home office-related expenses on your tax return. For example, if your home is 2,000 square meters and your office is 400 square meters, your office is 20% of your home’s total size.

If this sounds like you, it may translate into a deduction. Small business owners often burn the midnight oil and work off-hours from home. You can deduct rent paid for property used in your business, including the rent for the land and building where your office is located. Don’t include desks, chairs, filing cabinets, and calculators because those are capital items. Small items such as pencils, pens, stamps, paper clips, and stationery.

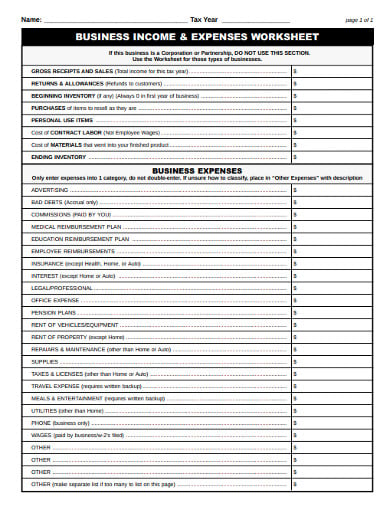

For example, grooming supplies used by a hair salon or tools used by a plumbing service. The cost of items that your business uses to provide goods or services. Digital advertising is also tax-deductible, and also the cost of registering your website’s domain name and web hosting.īusiness supplies. These include the cost of ads on Canadian radio and television stations and in Canadian newspapers. Examples include business cards, flyers, signage, branded promotional items, trade shows, designer fees, and printing costs.Īdvertising fees. Materials used to market your business and the cost of developing these materials. For a start-up cost to be eligible for a tax deduction, it must arise during the tax year (or fiscal period) your business started. Start-up costs for your business can include anything your business needs to launch, from equipment, machinery, and supplies to legal and accounting advice. What are the most common tax deductions for small businesses? If you use your car to drive to client meetings, you can deduct the round-trip mileage as a business expense. If you rent office space, the utility costs you incur are a business deduction. Things you use exclusively for your business in the space where your business operates.A dog training service needs leashes, collars, and treats. A landscaper uses sod and mulch to provide landscaping services. Things you use exclusively in operating your business.

Tax-deductible business expenses generally fall into three categories: That’s why it’s important to claim every expense you can, even the small ones: it all adds up! What kinds of expenses qualify as business expenses?Īny money spent running your business is considered a business expense, and you can claim it on your tax return as a deduction. In some cases, qualifying for enough tax deductions can bump you into a lower tax bracket, which can reduce the amount of taxes you pay for the year. Tax deductions are a small business owner’s best friend.Ī tax deduction is an amount of money the Canada Revenue Agency (CRA) lets you subtract from your total taxable income.

0 kommentar(er)

0 kommentar(er)